“I love your blog!” my friend told me, “but I don’t think I could have the money conversations that you do with the kids.”

That makes me sad, but I get it. Parents struggle to talk to their kids about money. In one survey by Boeing Employees’ Credit Union (BECU), only 24% of parents say they talk to their kids about money. 82% of parents said that fear was a barrier to talking about money (though few said they were personally afraid; it was other people).

What do I mean by “kids?” The parents in the BECU survey seem to think “kids” mean “high schoolers,” seeing as two thirds of the parents said they thought such conversations were best done by a professional financial adviser.

But I’m talking about kids, like, elementary schoolers. The elementary years are when kids develop habits and values. It’s when they learn what “our family does” in response to life’s challenges. Learning about money isn’t just head knowledge. It’s about getting started with habits that will last a lifetime.

24% is too low a percentage of parents talking with kids about money. Imagine if only 24% of parents said they talked with their kids about sharing, or following rules, or doing schoolwork, or right and wrong.

Here’s three reasons why teaching small children about money is difficult:

The amount of money that adults and kids handle is so different. Parents earn thousands of dollars a year, while children can only expect to handle small amounts of money. It’s hard for kids to understand the financial pressures parents face, or why parents keep saying we don’t have enough money for this or that. Parents are operating at a different level than the kids. This makes it tough to invite kids into conversations about money.

We often feel unprepared to talk about money. Our own money habits may seem very private. Sometimes we don’t have the best money habits ourselves. Talking with kids about money can make us feel vulnerable. Or maybe we feel like we just don’t know enough.

Kids don’t get enough opportunities to practice managing money, especially in a structured, habit-forming way. Remember how I said the elementary years are when kids develop habits? They get lots of chances to practice sharing, or following rules, or doing schoolwork, or acting on what is right and wrong. But, to take a sports metaphor, they don’t get enough “reps” to develop the “muscle memory” of managing money. Even if they get an allowance and make some money choices, there isn’t much density of practice there.

What can you do? I’ll give some suggestions.

Discuss managing scarce resources over time. Ask for their opinion about how we spend time on a family trip, how we spend the weekend, or what we buy for our pet. You don’t have to talk in dollar amounts - you can just introduce what the tradeoff is. For example, “we can either buy Bingo a nice bed or this cute dog sweater, but not both.” (You can read to your kids about choices like this in “A Budget for Bingo,” a wonderful children’s story by Tori Filas.)

Have the kids follow a money plan. Whenever your kids get money for any reason, have them divide it between sharing (i.e. donating or giving), saving, and spending. Do this every time, and it will become habit.

Go ahead, ask the kids questions from past Paper Robots articles! You can do any of the following:

What do we need from the store? What can we say “no” to?

Can you find a small item at the store that has a high price?

If you want to save up money, which is better: to make more money, or spend less money?

And finally, BUY MY BOOK! That’s the Big Announcement and Secret Project I warned you about last week! I have a book coming out from Revell (an imprint of Baker Publishing Group) to be released next winter. It will be called “Teach a Kid to Save: A Fun, Hands-On Approach to Building Smart Money Habits.” In it, I show parents how to overcome the obstacles to talking with kids about money and work.

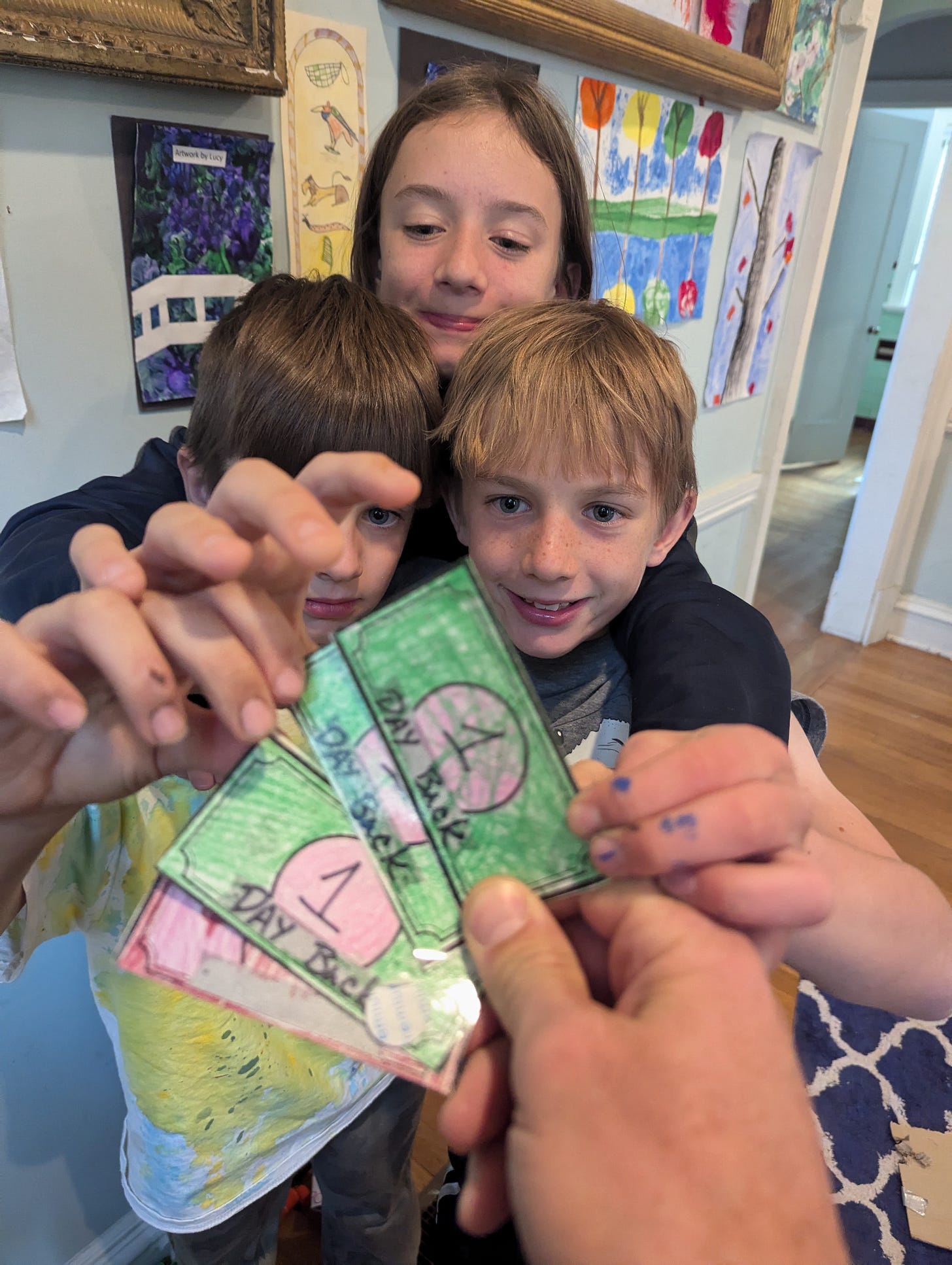

Teach a Kid to Save gives parents a system for teaching kids about money. That system is a household mini-economy, which is based on the mini-economy program that teachers have used in schools for decades. In it, both parents and kids have jobs that pay play money which they can spend in the household store. Parents and kids can also open mini-businesses. Here’s how this system overcomes the barriers to teaching kids about money.

It gives parents and kids a way to interact with each other in meaningful money choices, since they’ll be getting paid about the same amount in Mini-economy money. They'll be on the same level.

Since it’s play money, the stakes feel low. Parents can easily talk with their kids about play money. No discomfort about revealing how much you get paid, if you real-life money is under control, or whether you know much about how to manage money. The conversations just happen.

In the mini-economy, kids get lots of practice with money choices. Having a household job and business makes kids make choices about giving, saving, spending, buying resources, setting prices, and whether to spend the money they earn or invest it in their business. It gives them the “reps” they need to build money “muscle memory.”

I make the mini-economy easy to set up. You can do this system either as a short, fun game in the summer, or an ongoing way to manage chores and allowance, or something in between. I want this to be accessible for everyone.

I am going dark for the month of December while I finish the book manuscript, which is due to Revell in early January. But Paper Robots will be back on January 14th (I originally said the 7th, but let’s get real) to continue the conversation in the New Year.

Thank you for reading the newsletter. It’s been a fun Year One. Before January 14, go ahead and talk with a kid about some choice that involves a tradeoff—sort of a real-life game of “Would You Rather.” Any tradeoff between this or that. Let me know in the comments how it went! Learning about money is ultimately about making meaningful choices about resources over time. Everyone can do that, even small children. So give it a try. And have a wonderful holiday season.

Congrats on the new book.

It's hard to talk about finances. It is a very revealing topic since it often shows what our true priorities are in life.

Congratulations on the book!! We went to Harry Potter studios and the kids had a budget...it was nice to see them making choices and deciding their priorities!